Many people insist that charging interest on loans is not only immoral but downright evil. To understand why they are wrong, you must unravel lies stretching back millennia. Lefty Liars have been around for eons, creating Fake News and myths. A percentage of recorded history is fake because they wrote it for their purposes.

The past is littered with nothingburgers, and one example is usury – the lending of money in exchange for interest, sometimes at very high rates, sometimes illegally. Interest – a charge for borrowed money, generally a percentage of the amount borrowed, has its definition in the dictionary, separate from usury, which is odd.

Pronunciation

How you pronounce usury is important since many mispronounce it, as Tucker Carlson did the other day (sound warning).

Tucker vocalized it as ‘you zerry,’ which is incorrect.

Usury is pronounced the same way usually is, but with ‘ry’ instead of ‘ally.’ Usu ally ry.

Usurer is pronounced the same way treasurer is, but with ‘You’ or ‘U’ instead of ‘trea.’ U trea surer.

Pronouncing ‘Usury’ and ‘Usurer’

(adjust volume first).

Usurers have been maligned and persecuted throughout history by charlatans and thieves, and their story includes the persecution of Jews, who were often money lenders. Islam and Lefties side with those who hate usury, and sadly some good guys, like Carlson, are raised to believe it too, which is a shame.

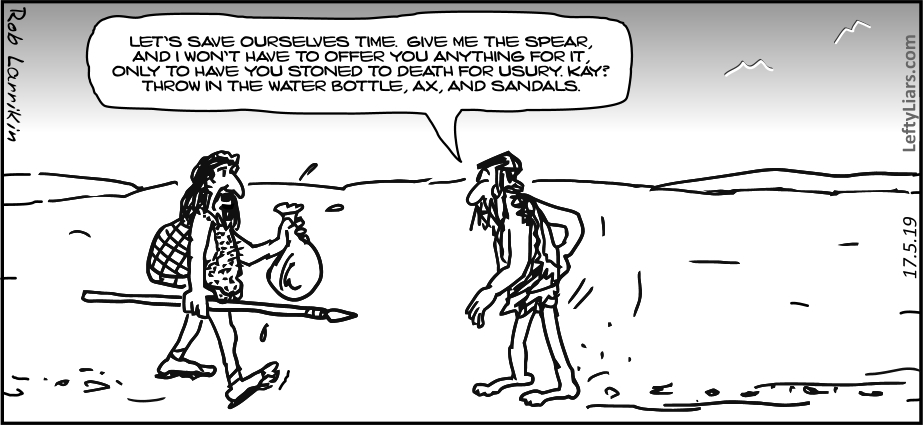

It would not be easy to know whom to believe, with opinions coming from so many directions. I will explain this lie, describing who created this myth and why. As with many controversial subjects, it is best to strip away centuries of misinformation and start at the start, with some simple cavemen conducting a natural transaction.

Limp and Hunter

Two cavemen were approaching each other. One was limping. He had been set upon by thieves who beat him and stole his weapons. The other was on his way to hunt, and his family depended on him returning with food. As they drew close, the Paleolithic men recognized each other, though each belonged to different tribes.

Limp said, “Hunter, I have been attacked, robbed, and wounded. Can I borrow your spear to use as a crutch?”

Hunter handed his water bottle to Limp in a gesture of goodwill. It was made of goat hide and lined with a goat stomach bladder. Limp pulled the wooden stopper out and gulped some water thirstily. “Thank you,” he gasped, handing it back. “I can return the spear tonight – I know where you camp.”

“Sorry,” said Hunter. “I need it to kill prey.”

“I’ll give you a bow and five arrows in exchange for the spear,” Limp offered desperately.

“Nope,” Hunter shrugged. “My wife will kill me if I don’t catch something.”

“Tell you what,” Limp went on. “I’ll return your spear tonight and bring the bow and arrows too. You can have both.

“I dunno,” Hunter scratched his chin. He took a swig of water.

“Plus some smoked pig meat,” Limp offered. “Enough for a family meal.”

Hunter wiped his mouth and smiled. “It’s a deal,” he agreed, handing over his hefty, bonehead spear. “Have some more water.”

“Many thanks,” Limp grinned, tipping the sewn leather bottle back.

The two Stone Age men parted company, one limping back home with a spear to assist him and the other making off towards the mountains with a stone ax, bone knife, woven grass backpack, flint-stone, cord, and water bottle.

Does anyone think there was anything immoral about this exchange? Hunter did not want to part with his spear. Is that wrong? To persuade Hunter, Limp had to increase his offer. Is that immoral? When the price was so high that Hunter could not refuse, he agreed. That is how business works. It is a high price, but that high price is what it takes to persuade Hunter, so it is natural and makes sense. So far, so good.

Let’s try it again, only this time we will introduce time.

Take II – Time.

The two Homo sapiens approached each other. Limp asked Hunter, “Can I borrow your spear? I will give you a bow, five arrows, enough smoked pig for one family meal, and I will return your spear as well tonight.”

“How can I say no to that offer?” Hunter replied, “Except that tonight we are eating with the chief. Could you come to our camp tomorrow night with the bow, arrows, spear, and food?”

“Sure,” Limp agreed, taking the spear. “I will see you tomorrow night, as agreed.”

Is that okay so far? Promised goods in exchange for a service to be delivered in the future, agreed to by both parties.

Take III – Currency

Limp said, “So tomorrow night, I will give you a bow and arrows, enough smoked pig for one family meal, and I will return your spear as well.”

“That would be fine,” Hunter replied, “Except, I just remembered, right now I already have three bows, fifty arrows, five spears, and plenty of smoked meat.”

“So, no deal then?” asked Limp, slightly annoyed. He was tired and needed to get home to rest.

Hunter pulled a pig fibula from his pouch. “Can you put three notches on this bone to show you owe the three items?”

“Three notches?” Limp looked confused.

Hunter gripped the fibula in front of him. “This will record your debt, of a bow and arrows, spear and smoked pig. When I am ready, I will show it to you to receive those things, and after you can keep the bone to show you paid.”

“Okay, I agree,” Limp said. He made three notches on the bone with a small flint-stone. Anyone could have made the notches, but both men knew that their God, Yawaar, was watching.

“Excellent,” Hunter said, placing the tally bone in his pouch. “Here is the spear.”

Still with me? We now have currency (tally bone) being exchanged for goods and services (rental of spear). The fibula will be used to collect (or ‘buy’) promised products (spear, bow, arrows, pig meat) in the future. If you agreed with the previous steps, is there anything about this last one that upsets you? No? Nor me. It is a simple transaction between two cavemen that will benefit both of them.

We are now ready to add interest.

Take IV – Interest

“Wait,” Limp said.

“What is it?” Hunter replied, turning back.

“I just remembered,” Limp explained. “I cannot deliver the goods for a while because I will be away.

“For how long?” Hunter asked gruffly.

“Two months,” Limp shrugged. “We have to visit our tribe up north.”

“You will return after that?”

“By Yawaar and all the gods, you have my word.”

“I don’t know,” Hunter looked doubtful. “My wife will be so angry…”

“I swear I will repay you.”

“I have been taken advantage of before…”

“Maybe I can pay a little more. Would that change your mind?”

Hunter squinted. He said, “Maybe we could do this if we add a stone ax.”

“No,” Limp said. “That’s too much, just to loan one spear.”

“Then don’t take the spear. Give it back,” Hunter began walking toward him.

Limp considered his predicament. There were no trees around, only sparse plains of dirt. Would his leg last? He tore his knee, and a crutch would help greatly.

“Well?” Hunter stood next to him, waving the bone.

“Okay,” Limp gave in. “I agree.”

“Good,” Hunter smiled. “Put another notch next to the others.”

Limp made the notch and returned the bone.

“Take care,” Hunter said, trudging away.

Limp leaned his weight on the stout spear and began to hobble home. He knew it was a lot to pay, but it was worth it since the spear would save his life.

The extra stone ax Hunter charged Limp was added “interest” on the loan.

Here is the financial and legal definition of interest:

1) Finance: A fee paid for the use of another party’s money. To the borrower it is the cost of renting money, to the lender the income from lending it.

2) Law: An advantage, claim, duty, liability, right, and/or title associated with a tangible or intangible item. Legal claim or right in or over an asset or property is called a security interest.

Does anyone believe there was anything immoral about this exchange? It saved Limp’s life, and he considered it worth the expense. You may think Hunter was greedy, but did he not take a risk in giving his spear to Limp? What if Limp had taken the spear and never returned to pay his dues? Hunter would be minus a bone-headed lance without the promised stone ax, bow, arrows, or pig meat. He would have disadvantaged himself for naught and probably made his wife angry in the process, which could affect his marriage.

He also increased the danger to himself by going hunting without his primary weapon. What if he was attacked by the same thieves to whom Limp fell victim? What if he was also wounded and needed the very spear he gave away to lean on himself? Would another caveman happen along to save him by renting him a spear? That was highly doubtful.

Hunter had every right to charge the amount he did, as his risks were considerable. He saved the life of another while putting his own at stake. Does he get any credit for this? No, most people will simply call him greedy and cast dispersions at him. They are happy to use his services when they need help but have nothing but contempt for him immediately after the loan. As soon as they find themselves in trouble financially, they begin to attack the lender, saying he is greedy and should be put in prison. It is how they avoid debts and dodge paying.

Now to the final chapter regarding Limp and Hunter.

Take V – Dishonesty and Theft

Limp made it home and told his family what happened, including the details of his deal with Hunter and how the debt had to be paid in two months. At first, they were all glad that he was alive and were too busy rejoicing to worry about the debt. However, as the weeks went by, Limp and his wife Gab began to worry about the payment.

“It’s an awful lot of stuff,” Gab said, “just to borrow a spear!”

“Yeah,” Limp agreed. “A stone ax, a bow and arrow set, and a family meal of smoked meat, just to use a spear.”

“It’s outrageous,” Gab lamented. “Who does that Hunter think he is?”

Gab’s father was even more emotional. “It’s theft, basically,” he insisted. “The guy is robbing you blind.”

“I agree,” Limp’s sister chimed in. “It’s way too much just to loan a stupid spear. F— him. Don’t pay.”

“I did promise in front of Yawaar, though,” Limp pointed out, looking up guiltily.

“You were half out of your wits with pain and hunger,” Gab declared. “He took advantage of you.”

“You think Yawaar cannot see through this sham?” his father-in-law told him. “God is a lot smarter than you think.”

“No, but I did promise…”

“Promise?” Gab shouted. “What about your family? Paying that greedy Hunter will hurt us financially! It will mean less food in our mouths!”

“That’s true,” Limp began to concede. He partly hoped this would happen because it would save energy and time.

“That’s the spirit,” Gab’s father said. “Let’s have another drink.”

Before long, it was decided. Limp would not pay Hunter back, and he would keep his spear, too, to punish him for being so greedy. Gab’s father had spoken with the tribal witch doctor, who agreed there should be a law to make such usury illegal. He cleared this with the chief, who decided it was not only wrong but wicked.

“Our chief has declared,” the witch-doctor proclaimed before the whole tribe, “that from this day forth, charging high fees in exchange for lending things will be illegal and punishable by death. Such greedy swindlers and profiteers will be burned alive!”

That night, once the entire tribe was drunk, ten tribesmen formed a lynch mob and went to find Hunter. After dragging the man from his mud hut, Limp held Hunter’s spear to his neck and ordered him to march to the execution pit. Hunter was burned alive. His screams could be heard by Gab, sitting miles away in her hut. She smiled and thought about the money she had saved.

Investing

Mark I Homo sapiens have a few bugs in their design. Many cannot understand why money lending and investment are essential to a country’s economy. They get hung up on simplistic notions of greed and need, and this Achilles’ heel stretches back to our tribal ancestors. The thinking proceeds in the following way:

1) Mr. Smith acquires an object and holds onto it, knowing it may go up in value.

2) Enter the bully and thief, Mr. Cheat. He asks, “How much to buy that item?” Smith either declines to sell or asks a high price, X, and both of these answers anger Cheat. He says, “You have no right to charge such a high price for something that we all know is only worth Y.”

4) Cheat tries to bring in legislation to stop Smith from holding onto the object or “overcharging” for it, trying to effectively steal the item from Smith.

5) If Cheat is successful, he gets the product for much less than X, and may even have Smith punished in the process, to “teach him a lesson.”

Glaring Inconsistencies

Cheat will happily support his grandmother collecting antiques, to sell them at much higher prices years later, or for his son’s house to accumulate value over the years. He will be pleased if his daughter’s art or his nephew’s wine collection accrue in value as they age or of being paid interest on his own banked money. Yet, he cherry-picks particular investments others make to object to them when it suits him. For instance, if there is a drought and someone offers water at a high price, Cheat will decide that because he needs water, the water seller is a crook and should be forced to provide the H2O free. It never occurs to the dunderhead that if the water seller were not allowed to make a profit, there would be NO water, expensive or otherwise. Or perhaps it does occur to him. Still, he uses the argument that ‘water is essential’ to get his way regardless.

Gathering Interest (Usury)

A similar thing happens with Homo sapiens 1.0 regarding money lenders and the interest they charge. It was a natural five-step process:

- Someone is desperate for credit.

- A second person refuses to provide that credit.

- The first person offers a substantial reward for said credit.

- The lender relents and grants the loan.

- Now the borrower defaults and uses the ‘usury is evil’ excuse to get out of paying, often creating trouble for the lender in the process.

This vicious circle is often forced upon those with money. “You give me that loan or else.”

Aristotle had some great ideas, but even he had this Homo sapiens 1.0 fault. As a human, he could not see his way around interest, writing:

The most hated sort [of moneymaking], and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural use of it. For money was intended to be used in exchange, but not to increase at interest. And this term interest, which means the birth of money from money, is applied to the breeding of money because the offspring resembles the parent. Whereof of all modes of making money this is the most unnatural.

He acquired this idea from his teacher Plato. Both of them thought of money as merely a static object, not as an item representing a medium of exchange, a unit of account, a store of value, or a deferred payment standard. They failed to understand that although money, the hard currency, could not create more wealth by itself alone, sitting on a shelf, it could be invested in something that would gain value or used to help someone else earn money and thus generate a reward for the risk-taking lender, who had delayed his use of it.

For instance, a man desperately needs a loan to save his business, and the lender does not want to help. The needy businessman begs the moneylender, offering to pay high interest. The moneylender agrees to take the risk and gives the businessman the loan, saving his business from ruin, and the merchant is happy to pay the moneylender back with interest. That happens millions of times every day around the world. Indeed, it is the backbone of small and big businesses. Many companies would not exist if not for loans, and most homeowners today would be without their houses too. Much anti-usury noise comes from a loud minority who do not like paying debts or are jealous of wealthy moneylenders.

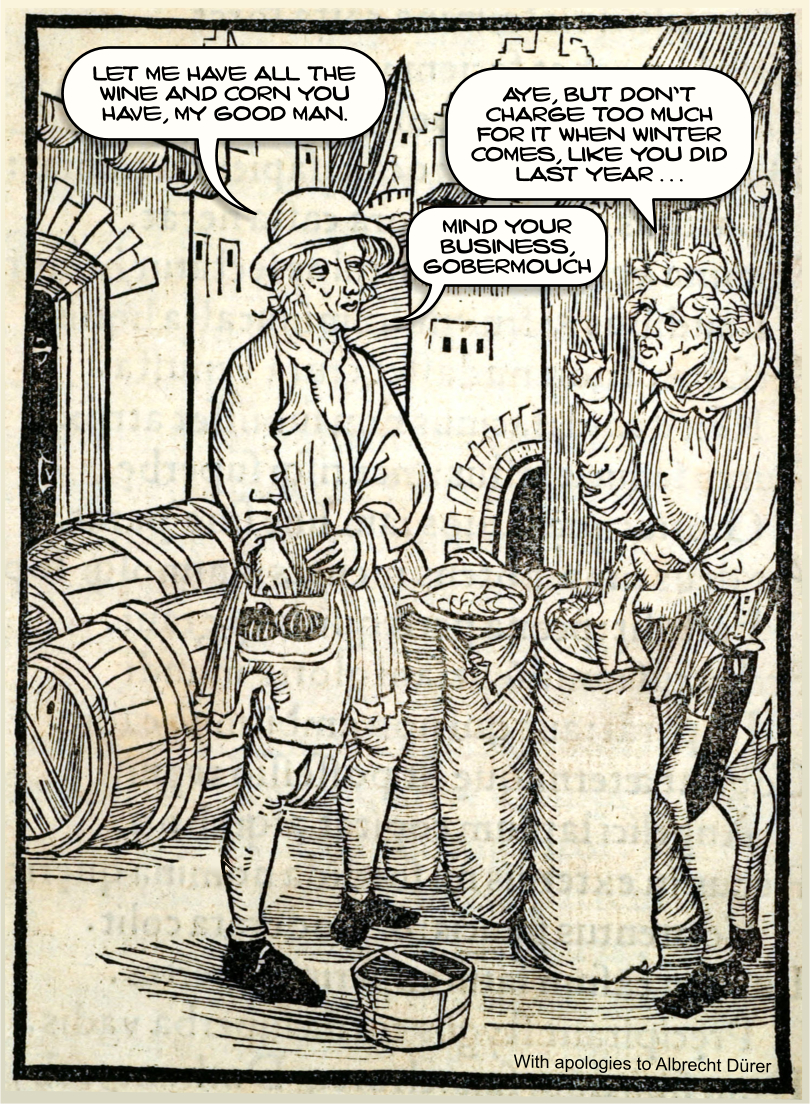

Many Lefties praise Sebastian Brant, Ezra Pound, and other literary figures in history who opposed usury. From The Ship of Fools, a 1494 book by theologian Sebastian Brant, a French anti-Semantic satirist, includes the woodcut above, by Albrecht Dürer, called “Usury and Profiteering.” Balloons were added to beef it up. A ‘gobermouch’ was an old word for a nosy, prying person who liked to interfere in other people’s business.

Above and below Dürer’s engraving are Sebastian Brant’s words in black. I answer each line with my own, in red:

The usurers are vile and rash, [ Say envious thieves who steal their cash, ]

The man of poverty they thrash, [ Spake robbers with teeth that gnash, ]

They’d care not if the world should crash. [ Shout jealous bandits high on hash. ]

93. USURY AND PROFITEERING [ 93. Providing a Service and Earning a Living ]

We’d punish him for all his tricks, [ Hurting him is for socialist hicks ]

From him we must remove the ticks [ Who’d rob such ticks, but Bolsheviks? ]

And pluck his pinions with elation [ Plucking such wings brings litigation. ]

Who buys up goods on speculation, [ Investing is standard in every location, ]

The wine and corn in all the land, [ Buying to sell later is not banned, ]

No sin, dishonor stays his hand, [ Semantics, to break laws of the land. ]

So that a poor man cannot flee

Starvation with his family. [ Your poem is a lie, written hammily. ]

Thus prices mount, it must be clear, [ Weather and wars (shrug), see the cashier, ]

They’re higher now than those last year, [ Unlike your Intelligence Quota, I fear ]

If wine now costs a scant ten pound,

Next month ’twill certainly be found

You’ll pay full thirty when you buy. [ To cover your theft it has to be high. ]

The same is true of wheat, spelt, rye. [ Without such profit, there’ll be no supply. ]

The great abuse need not be stressed [ Lenders are the ones you molest ]

Of money, kind, and interest, [ For its theft you should suffer arrest, ]

Of loans, pawn business oft unsound: [ Debtors want Truth to swing around, ]

In one day some will earn a pound [ Only after one year be crowned ]

More profit than a year should hold, [ You borrow money and so are tolled,]

They lend in silver, ask for gold, [ But should mere askers be trolled? ]

You borrow ten, eleven’s due, [ That part is earned you miserly shrew, ]

They’re more usurious than the Jew. [ If that is against the law, then sue. ]

Their business now the Jews may lose,

For it is done by Christian Jews. [ That’s their business, now pay your dues! ]

With Jewish spears they run about,

I could name many such a lout,

Unsavory are their transactions [ To those who hate simple fractions ]

Yet are not stopped by legal actions. [ Legal despite your klepto reactions. ]

With joy they greet the hailstorm’s might [ Liars and thieves say so, that’s right ]

And see the hoarfrost with delight, [ That’s an anti-profit fool’s sound bite, ]

But often too, deprived of hope, [ Wipe away such tears with soap, ]

You’ll find men hanging from a rope. [ True, some fail and cannot cope, ]

Harm common weal and help your own, [ Common weal depends on your loan, ]

And you’re a fool, but not alone. [ And this poem is a lying monotone. ]

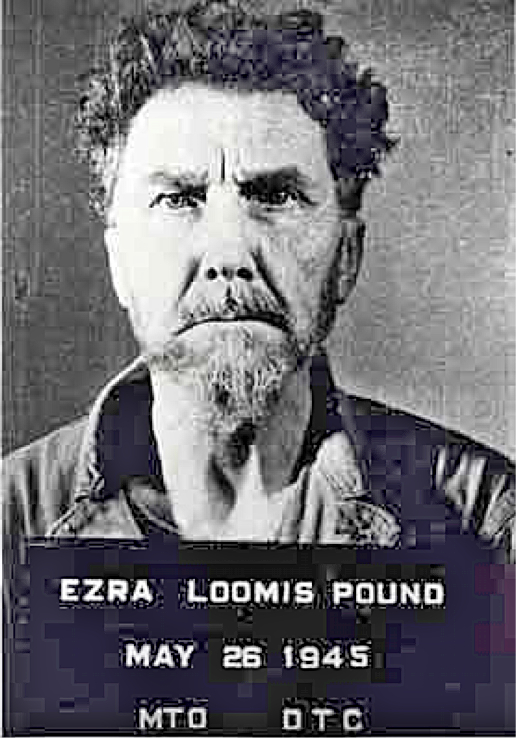

Ezra Pound

Another anti-usury anti-Semitic poet was Ezra Pound, an expatriate American traitor who went to Italy and supported Mussolini and Hitler. He blamed WWI on usury and international capitalism. From Wikipedia:

[Ezra Pound] moved to Italy in 1924 and throughout the 1930s and 1940s embraced Benito Mussolini’s fascism, expressed support for Adolf Hitler, and wrote for publications owned by the British fascist Sir Oswald Mosley. During World War II, he was paid by the Italian government to make hundreds of radio broadcasts criticizing the United States, Franklin D. Roosevelt and Jews, as a result of which he was arrested in 1945 by American forces in Italy on charges of treason.

This wild-eyed Lefty wrote a long, incomplete poem in 116 sections, called The Cantos (from the Latin Cantus, ‘song’). Some of it attacked usury and Jews, but at the age of 87, Pound changed his mind, saying he had been confused; that it was not about usury but about avarice (greed). He was still wrong. As Ayn Rand and Milton Friedman pointed out, greed is very important. I will add to their message by saying that without it, mammals themselves would not exist, let alone humans.

Religions

Several religions have banned usury, including Islam. Anyone found charging interest was put to death at various times and places throughout history. The Koran tells Muslims they will burn eternally if they deal in usury. From verse 275:

Allah has permitted trade and has forbidden interest… But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein.

The Catholic church warred against usury for a thousand years but recently eased up and stopped enforcing those rules. Millions were told down through the ages they would burn in hell forever if they charged interest. When it changed its mind about usury, did the church ask the keepers of hell to stop incinerating all those innocent folk? When Islamic nations finally change their minds, will they go back in time to sew all the thousands of decapitated heads back on?

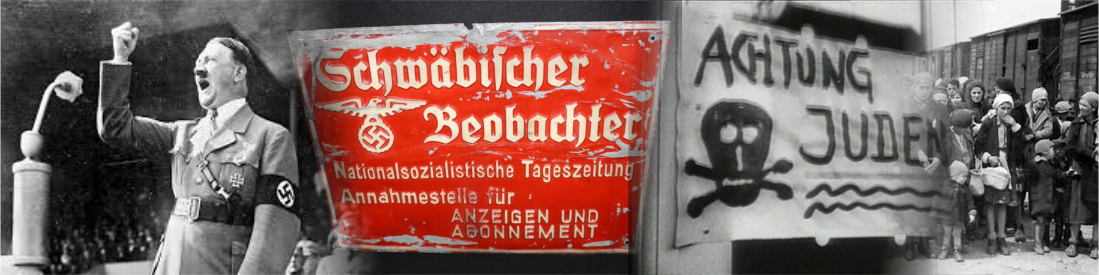

National Socialists

Adolf Hitler and his Nazi Party were against usury but charged interest on the money people owed them. They also hated Jews to death, as we know. From the Yale Law School, point 18 from the program of the National Socialist German Workers’ Party:

- We demand that ruthless war be waged against those who work to the injury of the common welfare. Traitors, usurers, profiteers, etc., are to be punished with death, regardless of creed or race.

Socialists hate the rich; they hate Jews and moneylenders, yet they earn lots of money on high-interest deposits. They are hypocrites all and the biggest thieves on the planet. Along the way, their schools have sucked many good people in too. Colleges taught many conservatives that usury is evil, as Tucker Carlson showed us last week.

[Sound warning]

Tucker Carlson, Bernie, and AOC

Last Friday, 10 May 2019, Tucker Carlson praised Alexandria Ocasio-Cortez and Bernie Sanders for wanting to restore usury laws and cap interest rates at 15% on credit cards and other loans. I will answer Tucker’s main points:

Tucker: [Banks] are getting rich from your debt.

That is untrue. Banks lend money for housing, business, personal loans, and credit cards, but they also place money in investments and securities. Those may include real estate, stock, goods and services, building projects, and others. Most borrowers pay back their loans, which, combined with profits from other investments, is where banks make money. However, that is not “getting rich from your debt” because debt does not pay anything to banks; people do. The correct statement would be, “Banks make some money from your loan payments, and other money from other investments.” Debts do not make anyone wealthy.

Tucker: The bill would also apply the same 15% limit to consumer loans. It would ban, in effect, payday loans, those loans whose interest rates can exceed five or six hundred percent every year.

A payday loan (also called a payday advance, salary loan, payroll loan, small-dollar loan, short term, or cash advance loan) is a small, short-term unsecured loan, regardless of whether repayment of loans is linked to a borrower’s payday. The loans are also sometimes referred to as cash advances.

Most of these kinds of loans operate on a similar interest rate to credit cards and can vary from low to high. The interest is rarely as high as five or six hundred percent. Tucker has pointed to the extreme examples, ignoring that 99% of people using payday loans do not suffer such exorbitant rates. It would be like an anti-car person saying, “Some car drivers burn to death in auto wrecks, so we should ban cars,” while ignoring the billions who do not die in auto-wrecks and the significant advantages cars bring to most people.

Tucker: On this one issue [Bernie Sanders and Ocasio-Cortez] are absolutely, indisputably right. There’s a reason why the world’s great religions condemn usury and why societies have restricted it for thousands of years.

Sorry Tuck, but Bernie Sanders and AOC are unequivocally, incontrovertibly wrong, as are all anti-usury zealots. There is indeed a reason why Islam and other churches of the past condemned usury, and it happened for three reasons; jealousy, theft, and church donations.

Either a person was jealous of the wealth made by lenders, or wanted to avoid their debt to the lender, or believed that more people donated to the church when they were not burdened with debts. Many had a strong incentive to hate usurers. Banning them gave pleasure to the haters and money to the thieves. If fewer worshipers had debts, they could donate more to the church. The trouble is that banning credit hurts the poor, who need it most.

A priest receives a will from a deceased parishioner who left his house to the church. The clergyman collects the keys only to find a caveat on the property because the dead churchgoer owed debts to a Jewish moneylender. The priest is furious. The house has to be sold to pay the debt, so the church loses the asset. The priest stamps his feet and shouts, “Damn those usurious Jews to hell!”

The priest failed to appreciate that the parishioner’s failure to pay a debt was not the Jew’s fault.

Today churches are very wealthy and pay no tax, so they should be grateful for their wealth and leave businessmen the hell alone. The Catholic Church no longer persecutes them, and Islam should follow suit. Killing businessmen is hardly helpful to society.

Tucker: High-interest rates exploit the weak.

Go back to the person in need. He is weak, limping, and in poor condition. He begs for a loan. The lender is usually the person saying, “No, sorry, you are too much of a risk.”

The beggar says, “You charge 10% per year. I’ll pay you 10% for a week! Give me $1000, and next week. you’ll get $1,100.”

“You are too much of a risk,” replies the lender. “I will probably lose my $1,100.”

Again, the beggar pleads, “Okay, I’ll make it a hundred percent. I’ll give you back two thousand bucks in seven days.”

The lender is tempted but wary. “If I charge you 100% over a week, people will say I’m evil, and governments or churches will condemn me,” he points out.

“I’ll tell them it was my idea,” the beggar promises. “Please, I must get this money to save my family.”

“All right,” the lender finally agrees. After signing a contract, the beggar receives his $1000 and hurries away.

A week later, the beggar is nowhere to be found, nor answering calls, texts, or emails.

When the lender takes him to court, the beggar tells the judge, “He ripped me off your honor, charging me a ridiculous 100% over one week! He made me promise not to tell anyone.”

The judge asks him why he signed the contract.

“He pushed me to sign it, yer honor. I never had no chance to see it, as god is my witness.”

The judge looks fiercely at the lender. “You have exploited the weak,” he declares, fining the moneylender $10,000 plus court costs. The beggar keeps the $2,000. Altogether the lender loses $14,000. Who is being exploited here, Tucker?

Tucker: Credit card debt destroys people.

Most users easily handle credit card debt. A loud minority who cannot manage it makes much noise, readily turning to anti-usury arguments to justify defaulting. Banks usually take great care in handing out credit cards, obtaining details of their wage, employer, time employed, and looking at applicants’ credit histories. At times they appear to give credit cards to anyone, but a closer examination reveals they have statistics to back up their choices. For instance, teenagers residing in Hollywood mansions will statistically be a safe investment regardless of their history. The debt accumulated by that vast number of folk is paid off without a sound. The minority who cannot handle their debts still have problems because when a card company refuses them, they borrow money from relatives, friends, or gangsters. They will always have debts they cannot pay; they will only hurt other innocent parties or even be killed. To this degree, credit card companies save lives since if you cannot pay them, they do not murder you.

Greed

Greed is not a dirty word, and neither is usury. A minority of charlatans have made both those words look evil over the centuries, and it is time we threw their views in the dustbin where they belong. Without greed, there would be no ambition. “Wanting more than you need” is why rock stars have multiple albums when they could have retired after the first. Would you want the Beatles to have retired after album 1, Please Please Me? We would never have this if they were not greedy.

Greed is the reason movie stars make many movies when they already have gazillions of dollars. It is the motive for Roll Royce to continue producing superb engines. Take greed away, and you lose all that; in fact, you lose most things, including all mammals. You could be an ant because they operate on mechanical instincts, but even they “look” greedy. When two ants come across a crumb, they fight over it like a pair of seagulls on a French fry.

Often the loudest critics of greed are the greediest for attention, affection, sympathy, and assistance and go to great lengths to acquire these, along with publicity, advertising, backing, promotion, bookings, audiences, exhibitions, galleries, shows, and book launches.

Show me a Left winged poet, and I will show you a loudmouth, greedy for attention in all its forms, defaulting on loans and using excuses like, “Why pay the bank back? It’s rich enough already.”

Let us go back to our cavemen. Notice from that example, there is nothing wrong with charging for a service or the loan of a product. It can save lives in many cases, so it is a great thing to have. One can show millions of such examples.

Cap interest rates and people will turn to other choices, including gangster loans and theft. A desperate person determined to get money will get it, using any means at their disposal. Banks provide high-interest cards to cover their risk. Prohibit such rates, and they will say, “Okay, no more cards for risky customers.”

Tucker would say, “That’s great because the risky customer shouldn’t have credit,” but where does he think those people go?

One answer is they get a loan from the Mob and then risk torture and death by defaulting. Another is to get a gun and hold up a 7-Eleven. Do-gooders are responsible for driving up poverty, crime, and murder, and while they do this, they help the Mob make money.

Prohibition taught us this lesson already. Banning booze only made criminals rich and grew the mafia. Capping interest rates will do the same thing. You may not like the alcohol industry or high-interest rates, but they are much preferable to rich gangsters riding around, causing mayhem.

One last point, Tucker. I like shortcuts because they save time. Here is one for you. Bernie Sanders and AOC are nuts. Never, ever agree with anything they say again.

Ever.

That happens millions of times every day around the world.exist